24+ Housing ratio calculator

Total Monthly Loan Obligation. Calculate Your Debt-to-Income Ratio.

Back End Debt To Income Ratio Debt To Income Ratio Debt Ratio Debt

If they had no debt.

. 1924 7150 0269 or roughly 27 According to the housing expense ratio formula youll spend around 27 percent of your pretax income on typical housing expenses. Debt to Income Ratio Back-end Ratio. In this case ½.

24 Housing ratio calculator Sabtu 03 September 2022 Housing ratio is calculated by dividing the monthly mortgage obligation by gross monthly income. That breaks down to 716758 monthly. Amp Pinterest In Action In 2022 Amortization Chart Amortization Schedule Mortgage Amortization Calculator.

As a basic rule the debt ratio should not exceed 36. Its part of the larger Mesoamerican Barrier Reef System that stretches from Mexicos Yucatan Peninsula to Honduras and is the second-largest reef in the world behind the Great Barrier Reef in Australia. To determine your housing expense ratio you divide the housing expenses you can expect by the income you expect every month.

The housing ratio is calculated by dividing monthly housing expenses by your gross monthly income. The formula looks like this. The rent-to-income ratio would be 40 which is higher than the recommended 30 threshold.

The housing expense ratio HER is commonly set at 28 percent for mortgage loan approval. As a quick example if someones monthly income is 1000 and they spend 480 on debt each month their DTI ratio is 48. This ratio calculator will accept integers decimals and scientific e notation with a limit of 15 characters.

The housing expense ratio formula estimates that youll spend about 27 of pretax income on regular housing expenses. Fidelity Investments Can Help You Untangle The Process. You end up with 14 or 14.

Or enter C and D to find A and B The calculator will simplify the ratio A. 1924 7150 0269 or nearly 27. The housing ratio is calculated by dividing monthly housing expenses by your gross monthly income.

Divide By Your Pre-Tax Income. Ad Work with One of Our Specialists to Save You More Money Today. Monthly Housing Expense PITI.

Debt-to-income ratio DTI is the ratio of total debt payments divided by gross income before tax expressed as a percentage usually on either a monthly or annual basis. The housing ratio should not exceed 28. Monthly or annual payments can be used to calculate the housing expense ratio.

The formula is as follows. For this example well use the median family gross income annual pre-tax earnings of 86011. To calculate your housing expense ratio divide your expected housing expenses by your monthly income.

To calculate the housing expense ratio lenders sum up all the housing expense obligations of a borrower such as operating expenses like future mortgage principal and interest expenses monthly utilities property insurance and property taxes etc. Lets examine an example a family with a pre-tax income of 7000 a month and expenses of 1000 a month. This is clearer if the first number is larger than the second ie.

Monthly Loan Payment PI. Calculated by dividing your fixed monthly debt expenses by your gross monthly income. What is a Debt-to-Income Ratio.

Debt to Income and Housing Ratio Calculator Connect with us Mortgages Analyzed - Twitter Mortgages Analyzed - Facebook. Housing Ratio should be around 28 or less. Housing Ratio is the monthly mortgage obligation amount expressed as a percentage of gross monthly income.

With the ratio 21 2 can contain 1 2 times. Monthly housing expenses includes real estate taxes insurance etc. Next its time to divide your expenses by your pre-tax income.

To determine our housing expense ratio well divide our expense 192550 by our income 716758. This computes to 0358 or 358 which means that just over a third of your pretax income would be going toward housing costs. Rounded up our result is 027 or 27.

It is also possible to have ratios that have. One of the greatest marvels of the marine world the Belize Barrier Reef runs 190 miles along the Central American countrys Caribbean coast. The sum is then divided by the borrowers pretax income to arrive at the housing expense ratio.

The ratio represents the number that needs to be multiplied by the denominator in order to yield the numerator. The debt-to-income ratio is calculated by dividing your fixed monthly debt expenses including the mortgage payment by your gross monthly income. As a basic rule the debt ratio should not exceed 36.

To calculate the housing expense ratio as an underwriter might see it you can divide your expenses 2689 by your income 7500. Applying the same numbers to the second calculator with the monthly rent being 2000 say a landlord wants the tenants income to be three times the monthly rent amount close to 30. The housing expense ratio is calculated by dividing the total housing expenses by the borrowers pre-tax income.

Estimated Total Housing Expense from above. Otherwise the calculator finds an equivalent ratio by multiplying each of A and B by 2 to. Debt level within acceptable range for most people.

Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment. Ad Buying A Home Can Be Complex. They can also be written as 1 to 2 or as a fraction ½.

Enter A and B to find C and D. Take the expenses 1000 and divide it by the pre-tax income 7000. When you set the gross income-to-rent ratio to three the outputs.

The next step is to compare your expenses to your pre-tax income. The housing ratio should not exceed 28. Housing Ratio Front-end Ratio 000.

If you dont have your real estate tax or insurance figures the American Housing Survey shows that the median taxes paid averaged 12.

What Happens To The Housing Market When The Stock Market Crashes And Interst Rate Rises Quora

If The Stock Market Crashes Will The Housing Market Crash Too Quora

Mortgage Calculator Monthly Payments Screen Mortgage Loan Calculator Mortgage Payment Calculator Mortgage Loan Originator

How To Price Your Artwork This Formula Makes It Easy

2

How To Get Out Of Debt Pay Off Debt Or Save Advance America

April 2022 City Observatory

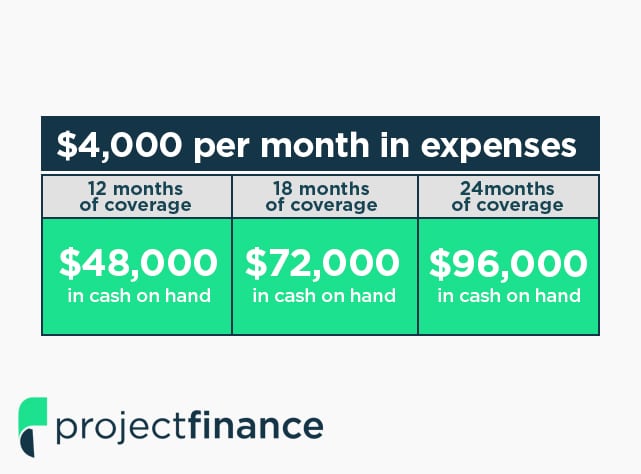

Faq How Much Cash Should Retirees Keep On Hand

Catchmark Timber Trust Inc 2022 Current Report 8 K

Catchmark Timber Trust Inc 2022 Current Report 8 K

Catchmark Timber Trust Inc 2022 Current Report 8 K

Investordaypresentation

2

Mortgage Tips And Tricks Assumption Assuming A Mortgage Home Mortgage Mortgage Tips First Time Home Buyers

Net Worth Calculator Balance Sheet Assets And Liabilities Etsy Debt To Equity Ratio Asset Being A Landlord

How To Price Your Artwork This Formula Makes It Easy

Catchmark Timber Trust Inc 2022 Current Report 8 K